If you’re a foreign company, here’s how to get a VAT number in the EU.

Each EU member state has its own VAT system. Each of these systems generates a VAT number that applies to sales made within Europe but not in the country where your company is based.

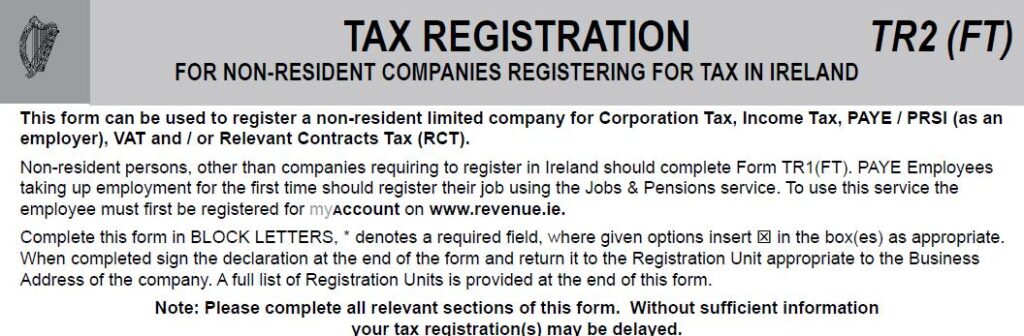

We’ve outlined the steps to obtain a VAT number using Ireland as an example to help you better understand the process.

1. Select a European Union country and register with their national VAT MOSS. Because it is all in English and has an easy-to-use design, the Irish VAT MOSS is the best choice for most foreign businesses. (You have the option of registering in any of the 28 countries that make up the European Union.)

2. Fill in your company’s information as well as your bank account information.

3. After that, fill in your personal contact details.

4. You’ll be asked about your company’s VAT history after that.

5. The portal will then redirect you to a summary page where you can review all of the data you entered. Make sure everything is in order!

6. Submit your work. That’s all there is to it!

That concludes the application procedure. Your VAT number will be sent to you either electronically or by mail.

TAS Consulting are here to provide all VAT compliance and custom clearance services for non resident companies. Contact us today!

TAS Consulting

TAS Consulting